GEM-BOOKS FAQ

Tax Report - Manual Method of Generating Tax Reports

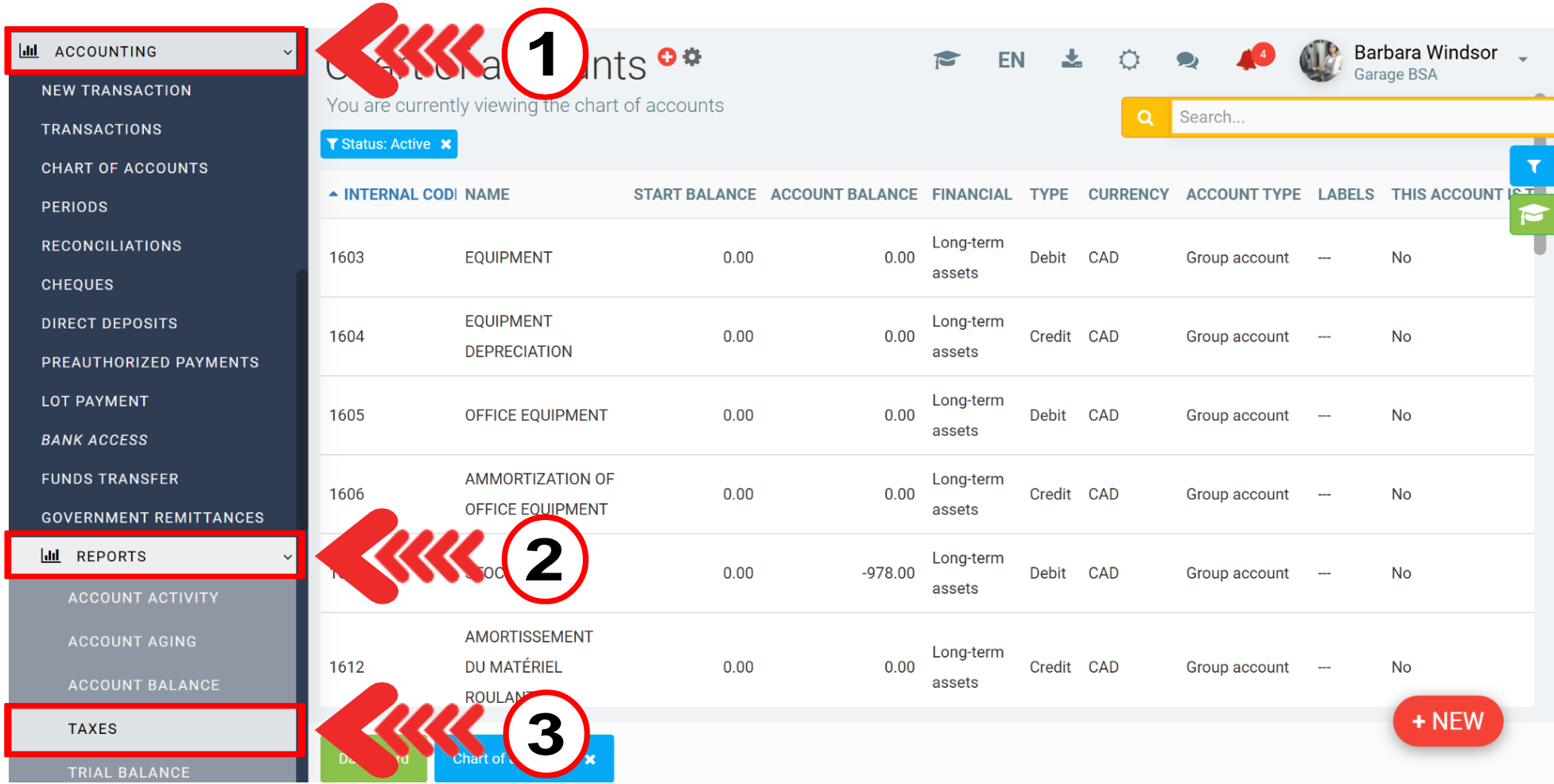

Select Accounting > Reports > Taxes.

Of course, check that these numbers make sense.

The column number (101, 201, etc.) corresponds to the same box on the government form, so you can fill it in easily.

For the transaction, there are several ways to proceed. Here's what we suggest

1) Perform the following transaction at the end of the period paid:

To DEBIT

- GST BILLED TO MY CLIENTS

- QST BILLED TO MY CLIENTS

To CREDIT

- GST COLLECTED BY SUPPLIERS

- QST COLLECTED BY SUPPLIERS

- SUPPLIERS ACCOUNT, SUPPLIERS 'GST/QST' or whichever you choose and make this transaction on the payment date.

To DEBIT

- SUPPLIERS ACCOUNT, SUPPLIER 'GST/QST' or the one you choose

To CREDIT

- BANK

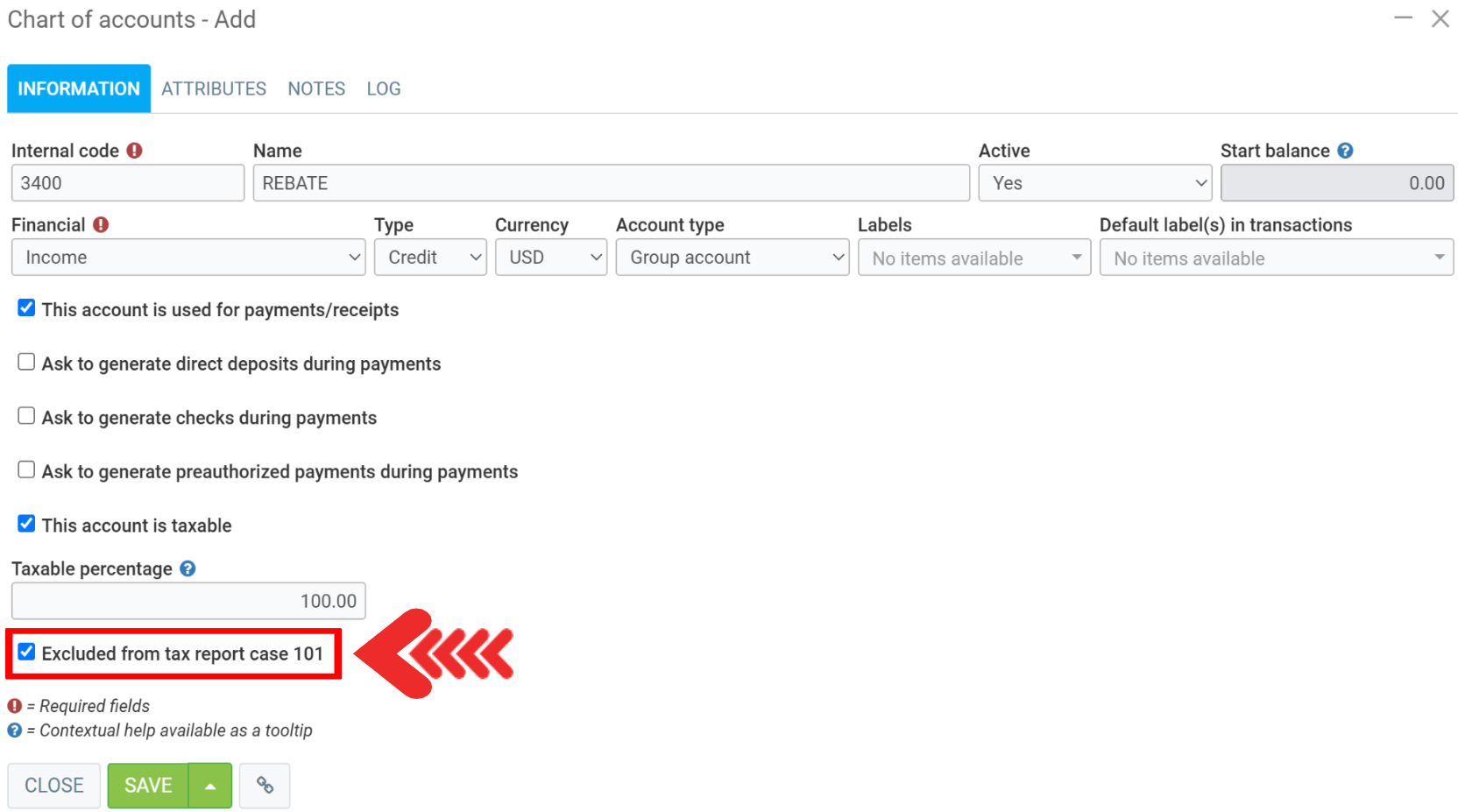

Note on "Box 101"

In Quebec, Box 101 is called "Sales". Sometimes, in this box, certain income accounts should not appear (for example, subsidy accounts). Before checking off such an account, ask your accountant. If you're normally in business, selling both taxable and non-taxable items, sales (Box 101) should normally have the total of all your sales (except under the simplified method).

In such a case, go to Accounting > Chart of Accounts, find the income account in question and put a check mark in the Excluded from tax report case 101 box. The amount of this type of income will not appear on your GST/QST report.

Other articles on the subject:

Tax Report - Automatic Method of Generating Tax Reports (Recommended Method)

Example of an International Supplier Invoice or Tax-Exempt Government Notice

Posted

6 months

ago

by

Bianca da Silveira De Amorim

#2462

231 views

Edited

6 months

ago